are nursing home fees tax deductible in uk

Anyone with capital below these amounts will qualify for some financial support. If you live in England and Northern Ireland and have assets of more than 23250 you will have to pay the full cost of your care and are referred to as a self-funder.

9 States With The Lowest Property Tax Rates In 2021 Homeowner Taxes Tax Deductions Mortgage Interest

Home nursing You can claim relief on the cost of employing a qualified.

. Is there any way her care home fees are tax deductible. A nursing home that provides 24-hour nursing care on site qualifies for this tax relief at the highest income tax rate. This is essentially how much money you can have before you have to pay for care home fees.

Matt Coward at accountant Price Bailey. If you need this information in a different. You can claim this relief as a deduction from your total income if the nursing home provides 24-hour on-site nursing care.

If you dont qualify for Continuing Healthcare but you need regular nursing care in a care home or nursing home you might be eligible for NHS-funded Nursing Care. In certain circumstances medical expenses for nursing homes can be deducted. This is a contribution towards the cost of your nursing needs.

Are nursing home fees tax deductible in UK. It is possible to deduct nursing home expenses for medical reasons. You can claim this relief at your highest rate of income tax if the nursing home provides 24-hour on-site nursing care.

If you your spouse or your dependent reside in a nursing home primarily for purposes of medical treatment then the entire nursing home cost including meals and lodging is typically deductible as a. Add the payments to your employees other earnings. In Scotland it is 28750 and in Wales the care and care home fees threshold is 50000.

Are Nursing Home Fees Tax Deductible In Uk. The 10660 tax free allowance is reduced by 1 for every 2 of taxable income above 25400 but cannot fall below the basic personal allowance of 8105. Generally if you your spouse or your dependent are living in a nursing home including food and lodging your nursing home expenses can be deducted as medical expenses.

If that individual is in a home primarily for non-medical reasons then only the cost of the actual. To do so she rents her home out but this is taxable income. If you are eligible for the General Medical Expenses Tax Relief Program you benefit from nursing home fee tax reliefA nursing home that provides 24-hour on-site nursing care or nursing homes which offer extended hours will qualify to provide you with this relief.

Claiming tax relief on your registration fee. As a UK tax payer you could save money on your RCN membership fees through tax relief. You contribute from income included in the means test such as pensions plus an assumed or tariff income based on your capital between 14250 and 23250.

HM Revenue and Customs HMRC allow individuals to claim tax relief on professional subscriptions or fees which have to be paid in order to carry out a job. This means that the portion of your income which is taxable at your highest rate of tax is reduced. Tax relief on nursing home fees.

Deduct and pay PAYE tax and Class 1. I have to pay a top-up of 153 a week for my mothers care home feesIs there any way that I can offset this cost against my income tax bill. This counts as earnings so.

You claim tax relief for nursing home fees under the general scheme for tax relief on medical expenses. Add in an element of nursing care and the costs rise to 776 and 949. Are Care Home Fees Tax Deductible Uk.

You may be eligible to claim tax relief on. You reimburse your employees costs. Expenses that are deductible also include fees to gardeners window cleaners domestic cleaners decorating.

Nursing home expenses. Between 14250 and 23250. Paying for a place in a care home is expensive and working out whether you can get any help to pay for it can be complicated.

You can claim this relief at your highest rate of income tax if the nursing home provides 24-hour on-site nursing care. If you are paying the nursing home fees you can get the tax relief whether you are in the nursing home yourself or you are paying for another person to be there. However if your relative has dementia but is otherwise in fairly good physical.

You may claim Income Tax IT relief on nursing home expenses paid by you. Medical expenses are deductible under the general scheme for tax relief and nursing home fees are eligible. Better still if this is the first time you have claimed tax relief you can do so for the current tax year and also backdate a claim for the previous four tax years.

The council pay the remaining cost of your care. Yes in certain instances nursing home expenses are deductible medical expenses. The average stay in a care home is a little over two-and-a-half years.

People with capital below these amounts can get financial support from their local authority which will pay some or all of the costs. You must pay full fees known as being self-funding. You claim tax relief for nursing home fees under the general scheme for tax relief on medical expenses.

Paying care home fees. You are able to claim for the last four years and claims may only be made where you pay the fee yourself. Its paid directly to the care home and the amount should be deducted from your bill.

If you your spouse or your dependent is in a nursing home primarily for medical care then the entire nursing home cost including meals and lodging is deductible as a medical expense. Are Nursing Home Fees Tax Deductible. If you are paying the charges for a nursing home you can claim the tax relief whether you are in the nursing home yourself or you.

This includes our registration fees. Dont forget to include taxable investment income in your calculations. This factsheet explains how the system works whether youre paying for your own place or you qualify for financial help from your local council.

Typical care home fees ranged from 511 a week in the north-west of England to 741 a week in London. When you claim tax relief for nursing home fees under the general scheme medical expenses are considered deductibleAn on-site nursing care facility that provides 24-hour service can allow you to make up the income tax withholding requirement at your highest tax rate. Up to 25 cash back Unfortunately no tax relief is available for privately funded nursing home fees.

If a single person is forced to go into a care home but because her home is worth 200000 she will receive no support to pay her care home fees.

How To Get Your Maximum Tax Refund Credit Com

How Do I Tailor My Self Assessment Tax Return Youtube

Ebitda Stands For Earnings Before Interest Tax Depreciation And Amortisation It Is A Profitability Kpi C Finance Blog Small Business Accounting Finance Advice

12 Medical Expense Deductions You Can Claim On Tax Day

Can I Get A Student Loan Tax Deduction The Turbotax Blog

Are Nursing Home Fees Tax Deductible In Uk Ictsd Org

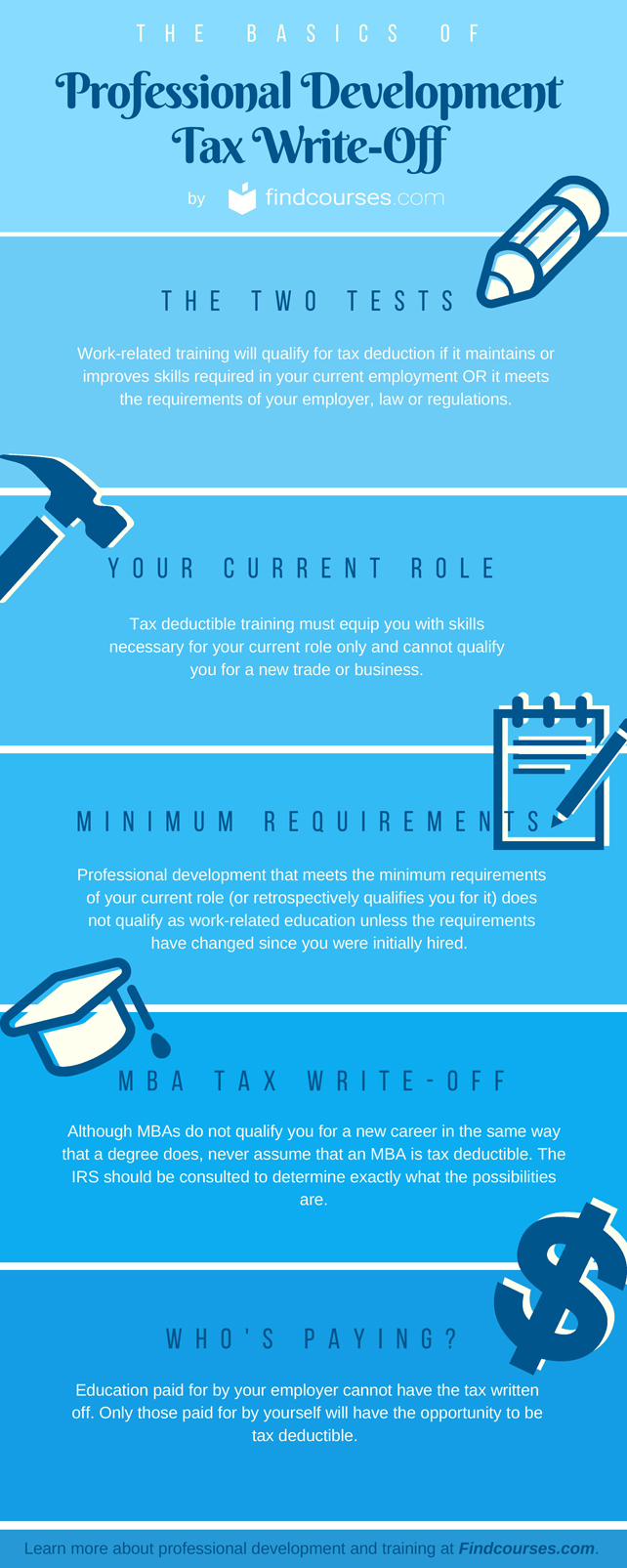

The Professional Development Tax Deduction What You Need To Know

Are Medical Expenses Tax Deductible

Retirement Planning An Infographic How To Plan Retirement Planning Retirement

Private Home Care Services May Be Tax Deductible

Irs Tax Forms Infographic Tax Relief Center Irs Tax Forms Irs Taxes Tax Forms

Health Insurance Claim Number Example Health Insurance Companies Online Insurance Lombard

3 Ways To Get A Healthy Hair Skin Things To Sell Lost Hair Natural Hair Styles

Tax Deductions For Therapists 15 Write Offs You Might Have Missed

Understanding The Mortgage Interest Deduction The Official Blog Of Taxslayer

For Tax Accounting Services In The Uk Contact Affinity Associates At 44 20 8903 2077 Accounting Services Sole Proprietor Business Finance