crypto tax accountant ireland

Every tax year the. For disposals between 1st to 31st December.

Lalor Company Cryptocurrency Tax Services In Ireland Lalor And Company

Each tax year the.

. Richard Lalor is the Principal of Lalor and Company Richard is a qualified Chartered Accountant CAI a Chartered Tax Advisor and a Cryptocurrency enthusiast. Our team of professional and highly qualified crypto tax accountants can help manage make this process for you easy and simple. Richard has traded across.

Maxwell Associates is an award-winning tax and business advisory firm. Use crypto tax software If youre looking to accurately calculate your crypto tax liability quickly and easily. Revenue accepts the possibility that a company can operate by dealing in shares hence the same analysis should apply to crypto assets.

Whenever you sell spend or swap crypto in other words dispose of it youll pay a flat 33 tax rate on your capital gains. Thankfully with your crypto tax report from Koinly and backup from a top Irish crypto accountant your crypto reporting is in good hands. 353 1 661 5999.

If you are an Irish citizen you will need to file your capital gains from crypto trading on a Capital Gains Tax form for both the Initial and Later periods. With the rise of cryptocurrency crypto-assets and NFTs the tax treatment of these transactions is coming under increasing scrutiny from both Revenue and asset holders. Positively though these profits would.

If the person subsequently sells those mined. One-off specialist advice on. Our practice is dedicated to helping crypto investors manage their taxes.

At M J Kane we can provide. 117 Baggot Court Dublin. I saw some previous posts but they were focused on accountants for corporations or small.

Browse our directory to find crypto tax professionals in. However the tax rules for crypto. All companies listed here are well.

Applied in an Irish context this would mean the same tax rate for individuals up to 55 and a higher tax rate for companies 25. Any recommendations for an English-speaking tax accountant not for business taxes. Whenever you dispose of a crypto asset and make a profit or a chargeable gain you could be subject to capital gains tax CGT in Ireland.

We only list CPAs crypto accountants and legal professionals who are knowledgeable and experienced in cryptocurrency tax and crypto regulation. It may be helpful to contact a tax professional before selling crypto for profit. Established in the early 1990s.

If you sellexchangegift crypto between 1st January to 30th November you need to pay the tax by 15th December of the same year. Capital gains tax. Tax Smart was established in 2016 and in association with our sister accountancy practice C.

Therefore individuals that are trading in cryptocurrency are required to file an income tax return Form 11. However if your annual profits. That is the profits from trading will be taxable under Income Tax rules.

Colby Cross is a licensed CPA and expert on crypto taxes. Capital gains tax CGT form. For more information check out our guide to crypto tax-free countries.

The following is a summary of the income tax rules that apply to companies. Capital Gain Taxes. Maxwell Associates which was established in the early 1990s we.

Our team of experts has years of experience with cryptocurrency taxes and we can help ensure that you pay the right amount of tax on your cryptocurrency gains. The Capital Gains Tax rate in Ireland is 33 so youll pay a flat 33 tax on any capital gain over the personal exemption amount. Capital Gains Tax Rate Ireland.

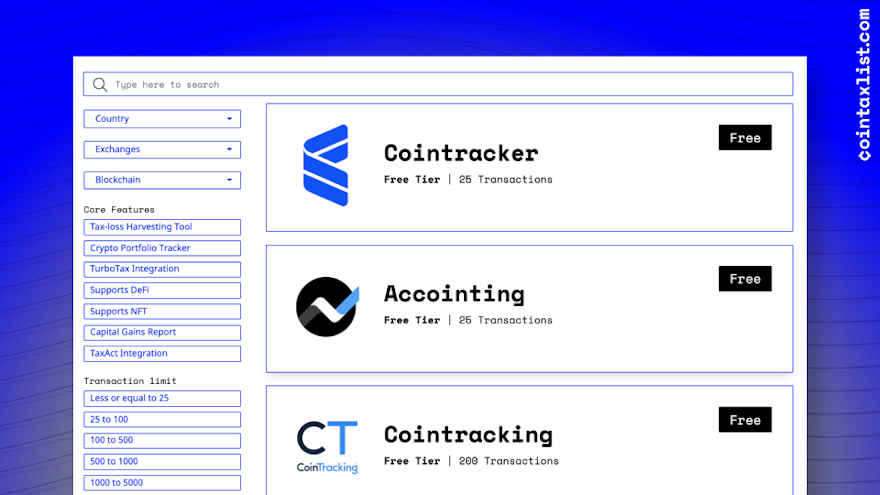

Top 5 Best Crypto Tax Software Companies

Crypto Tax Accountants Coinledger

I M A Crypto Tax Attorney Ama Today Jan 27 Starting At 10 Am Est R Cryptocurrency

Itas Accounting Cryptocurrency Accountant In Ireland Koinly

Crypto Taxes In Malaysia An In Depth Tax Guide Bitcointaxes

Revenue And Cryptocurrency Itas Accounting

Crypto Tax Accountants Coinledger

Cryptocurrency Accountant Bitcoin Income Tax Alt Coin Tax Crypto Tax

Crypto Tax Accountants Coinledger

Find The Best Crypto Tax Software For Reporting Your 2021 Taxes

6 Things You Need To Know About Crypto Taxes Interview With David Kemmerer Co Founder And Ceo Of Cryptotrader Techbullion

Koinly Review 2022 Cryptocurrency Tax Platform To Simplify Tax Reports

Crypto Tax Ireland Here S How Much You Ll Pay In 2022 Koinly

Section 179 Radiology Equipment Tax Deduction For 2016 Everything Rad

Definitive Cryptocurrency Tax Accounting Guide For Investors Camuso Cpa

The Ultimate Guide To Ireland Cryptocurrency Taxes In 2022 Coinledger

Crypto Taxes In Malaysia An In Depth Tax Guide Bitcointaxes

Koinly Review 2022 Truly Simple Crypto Tax Software Greenery Financial

/images/2021/08/16/cryptocurrency-taxes.jpg)

9 Different Ways To Legally Avoid Taxes On Cryptocurrency Financebuzz